Global Esports Betting Monitor: Q2/24

Sharpr is a weekly newsletter covering the intersection of esports, betting, and Gen Z

The Global Esports Betting Monitor is a quarterly edition developed in partnership with Abios to provide a holistic snapshot of esports betting trends and activity.

All data is captured from the Kambi network, spanning more than 40 operators in regulated markets across the globe, between April 1 - June 30, 2024. Market data may vary depending on the source.

Abios delivers an odds feed with engaging features such as same-game bet builders, player props, and flash markets. Discover more today.

Global Esports Betting Monitor: Q2/24

The second quarter brought a heap of action for esports bettors–from the Valorant Champions Tour to Mid-Season Invitational.

This quarter we dig deeper into the underlying trends seen in Q1 and more, including the regions, demographics, and tournaments fueling this burgeoning segment.

Click here to view the Q1 2024 report.

Valorant sees leap in year-over-year growth

Counter-Strike 2 continued to marginally extend its lead as the most bet-on esport, with 53% of betting handle in the second quarter.

Valorant produced 8% of handle in Q2 (up 5% from the previous quarter), with a key tournament–the VCT 2024 Masters Shanghai–taking place between May and June.

Call of Duty makes the top-five again this quarter–the title consistently hovers between 2-3% of betting handle.

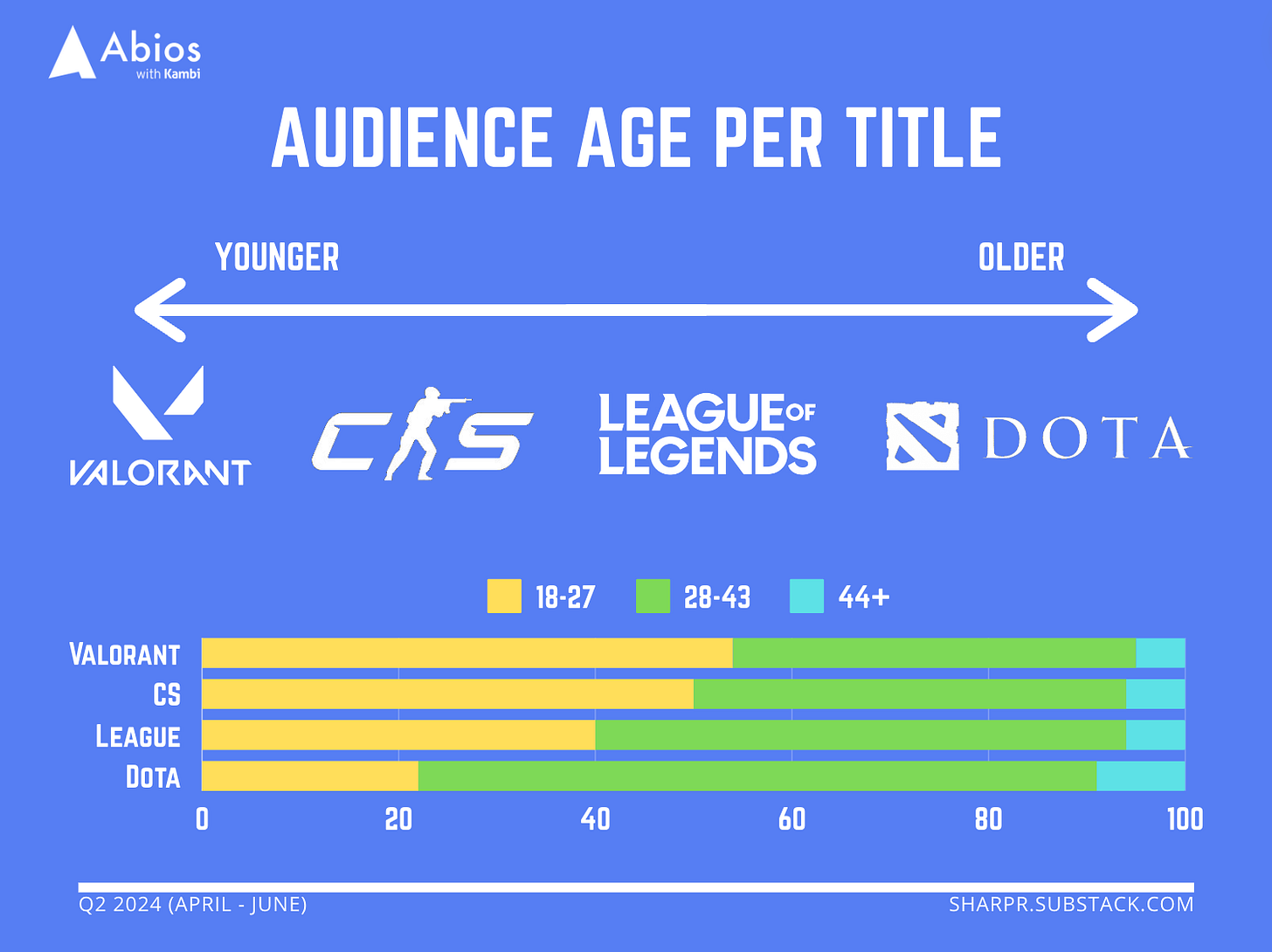

Valorant reaches younger bettors while Dota skews older

In April we highlighted how Gen Z (aged 18-27) made up over half of esports betting in Q1, which was generally consistent with our second quarter data (Gen Z: 50%, Millennials: 43%).

Examining age data by title, we see that Valorant is most popular among the 18-27 demographic, accounting for 54% of wagers; while Counter-Strike 2 trails nearby at 50%.

League of Legends skews slightly older with only 40% of Gen Z bettors, but not as much as Dota 2, where 78% of bettors are 28-and-older.

Esports betting branching out geographically

While the dominant share of esports wagers are still coming from Europe, with 71% of handle driven from the region in Q2 (down from 81% in 1Q24), handle is starting to diversify geographically. (Note: metrics are based on Kambi’s network and may not give a complete picture of popularity on a global basis).

Oceania and Latin America both saw noteworthy upticks in esports betting volume in Q2, representing 13% and 10% of wagers, respectively, whereas these regions typically court between 6-8% of handle.

Meanwhile, North America has consistently stayed in the 3-5% range.

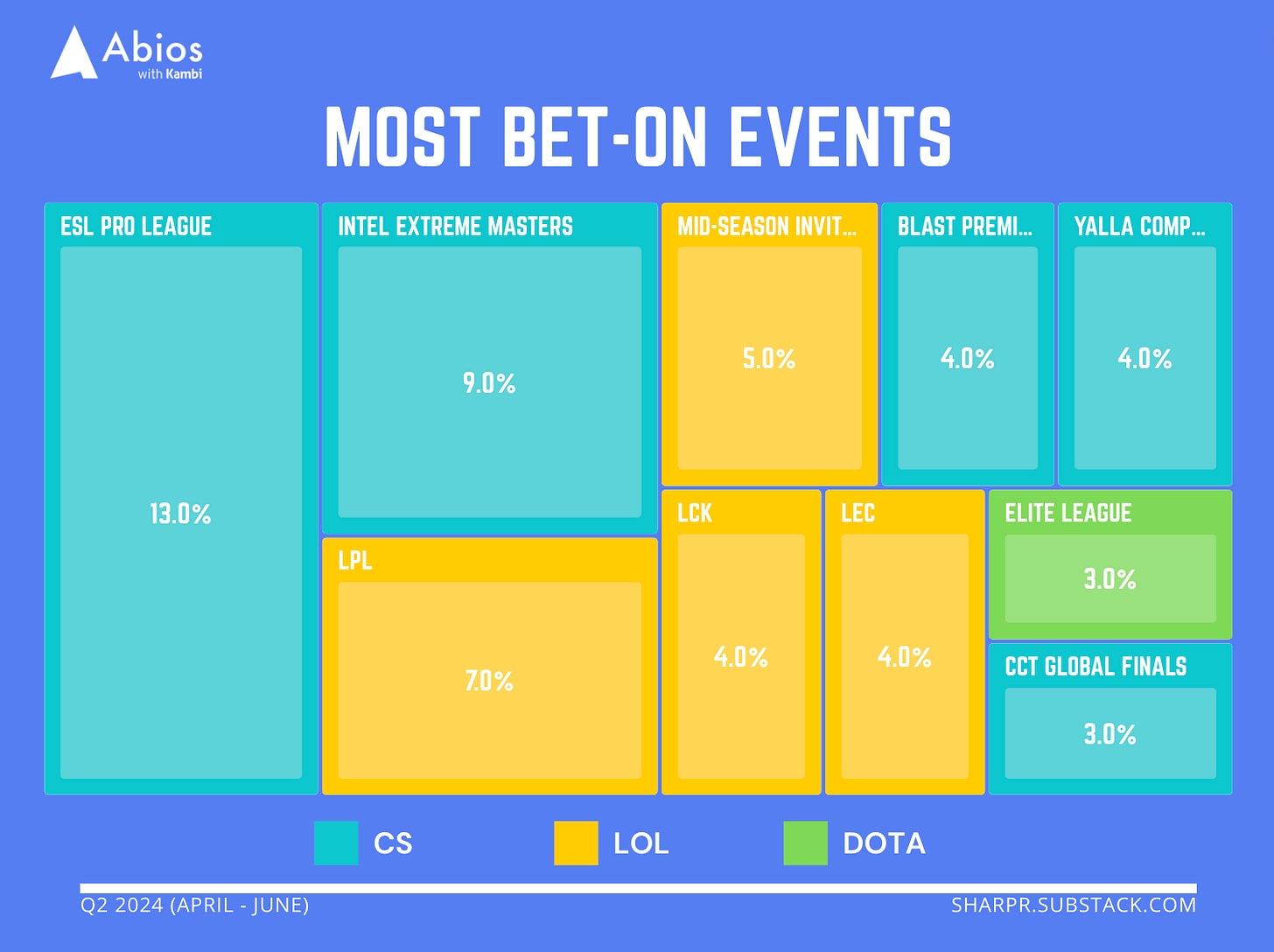

ESL Pro League, IEM draw nearly one quarter of Q2 handle

From the most bet-on esports events in the second quarter, Counter-Strike’s ESL Pro League and Intel Extreme Masters collectively generated 22% of handle.

The LPL, LCK, and LEC–the pro League of Legends leagues for China, Korea, and EMEA, respectively–accounted for 15% of handle; while the Mid-Season Invitational, a cross-regional competition between those leagues and others around the world, recorded another 5% of betting.

Elite League, a $1M online tournament in April, accounted for nearly one-third of all Dota 2 betting in Q2, which represented 3% of all esports wagers in the quarter.

Trendspotting

📈 Trending up: PrizePicks growing esports vertical

Daily fantasy sports operator PrizePicks has been dabbling in esports since 2020. Like many companies at that time, esports became an “important offering” at PrizePicks during the pandemic as sports leagues worldwide were withdrawn, CEO Adam Wexler said in a press statement at around that time.

But even as things returned to normal, and most operators flocked back to more lucrative sports segments, PrizePicks continued to build on its esports offering.

The company now offers esports DFS picks on more than a half dozen games that range from League of Legends to Halo. The operator added Rainbow Six Siege to its catalog in May.

In the second quarter, PrizePicks signed a deal with Bayes Esports to enhance its fantasy offering and later launched The Esports Lab, a “one-stop destination” for esports stats, live matches, and resources.

The investment seems to be paying off, per data shared by the operator last month:

Over 1M PrizePicks members have built an esports lineup to date.

Total esports entry fees have increased 110%+ between 2022 and 2023, and more recently, handle is up 90% year-over-year, the operator tells Sharpr.

Counter-Strike ranked fourth in entry fees and lineups built among all sports on PrizePicks last year, trailing only professional basketball, football and baseball.

Underdog Fantasy–a close competitor of PrizePicks in the DFS category–also offers esports lineups, although it’s unclear how much traction the category is gaining.

PrizePicks’ growing esports vertical isn’t a coincidence, though. The operator has spent quite some time inserting its brand in the sector’s social strata.

This includes previously inked deals with esports teams such as Ghost Gaming and TSM, as well as collegiate tournament organizer CSL Esports (recently rebranded to Playfly College Esports). They also operate a dedicated esports social media account with over 21,000 followers, and are frequently seen teaming up with gaming influencers on marketing campaigns.

⏭️ Coming up: Esports World Cup, July 4 - August 24

Taking place right now in the Saudi Arabian capital of Riyadh is the Esports World Cup.

The eight-week, cross-game competition funded largely by a grant from the nation’s government, is a first-of-its-kind tournament. The event will notably feature 21 esports titles and $60M in total prize winnings, the largest in history. But is the mouth-watering prize money enough to draw global attention? Some industry experts think not.

Former Esports Engine co-founder Adam Apicella says that the EWC has a “real awareness issue,” adding that the social hype around the tournament is “very low.” Former ESPN Esports reporter Jacob Wolf pointed out that the League of Legends portion of the tournament underperformed relative to other premium events on the competitive calendar. Generally I agree that the highlight clips and social discourse which typically tread on the heels of a major tournament like this have been curiously hard to come by.

Next quarter we’ll examine how the Esports World Cup performs against other tentpole betting events (Worlds, The International, ESL Pro League, etc.). Bayes Esports has assumed the role as the tournament’s supplier, named the official data partner for EWC last month.

Contact us

News tips, feedback, and sponsorship inquiries.

Reach me directly at luongomanagement@gmail.com 📩 or on Twitter 🐦

*Disclaimer: I am a full-time employee of Rivalry