Global Esports Betting Monitor: Q1/24

Sharpr is a weekly newsletter covering the intersection of esports, betting, and Gen Z

The Global Esports Betting Monitor is a new quarterly edition developed in partnership with Abios to provide a holistic snapshot of esports betting trends and activity.

All data is captured from the Kambi network, spanning more than 40 operators in regulated markets across the globe, between January 1 - March 31, 2024.

Abios delivers an odds feed with engaging features such as bet builders, player props, and instant markets. Discover more today.

Global Esports Betting Monitor: Q1/24

The esports calendar was packed with high-profile events in Q1, from the Six Invitational to the PGL Major in Copenhagen, and more.

Our maiden esports monitor walks through which events drew the most action, among which audience, and in what parts of the world to give readers a snapshot of the market and current trends.

Kambi’s network spans across 40 operators in more than 50 countries giving us a pretty good bird’s-eye view into the landscape, although it’s worth noting that market data may vary depending on the source.

Counter-Strike 2 takes the crown in Q1

Counter-Strike 2 topped the charts as the most bet-on esport in the first quarter, representing 52% of betting handle.

While the Counter-Strike franchise is already known to have a strong betting culture around it, the PGL Major Copenhagen 2024 in March likely contributed to a substantial uptick in wagers. The event’s final was also notably the most bet-on esports event in Q1, according to Abios.

League of Legends and Dota 2 both saw modest 5% deviations in betting handle while Valorant, a much younger franchise, remained on the board year-over-year with 3% of handle.

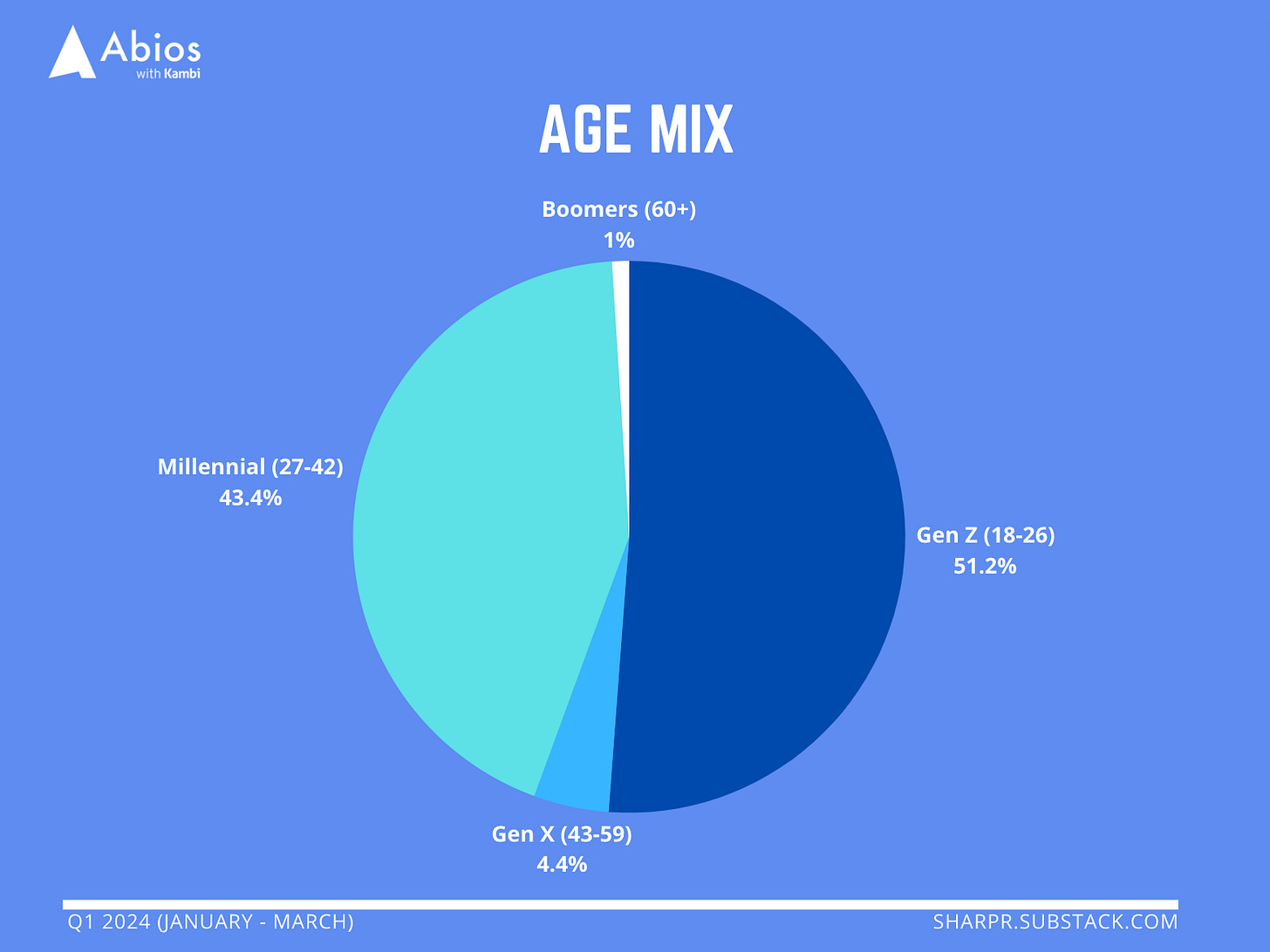

Gen Z made up half of all esports wagers

Gen Z (aged 18-26) made up half of esports betting in Q1 2024, highlighting its popularity among a younger customer cohort.

Millennials accounted for the second-largest demographic with 43% – players 42-and-under placed approximately 94% of esports wagers in the quarter.

Esports viewers are continuing to age up into the online gambling fold with an average age of 29-years old in 2024 among a broader population of 3.2B gamers worldwide.

Valorant trending up in Americas

While Europe accounted for the dominant share of esports betting across Counter-Strike, Valorant, Dota 2, and League of Legends, select titles trended more positively in some markets than others.

North America generated 12% of Valorant betting in Q1, signaling a potential culture fit between the first-person shooter and this mostly untapped market; Latin America represented another 12% of betting handle for the game.

Approximately 26% of Dota 2 bets were placed in Latin America and Oceania, while those two regions also generated 21% of League of Legends wagers, highlighting a concentration of fans in these markets.

Soccer, basketball most popular among esports bettors

Soccer, basketball, and tennis saw the most crossover with esports bettors in Q1 – while 91% of players who bet on esports also bet on other sports.

While these sports are generally more popular in Europe (where most of our data was captured), they also share a broader universal appeal similar to esports, where fandom isn’t typically limited to specific regions.

Meanwhile, only 16% of esports bettors wagered on football, despite the NFL Playoffs and Super Bowl landing in the first quarter.

Valorant, Dota 2 recorded most in-play bets

Live betting continues to be popular among esports bettors, making up slightly more than half of all wagers in the first quarter – in Q1 2023, 62% of bets were placed after matches had started.

That figure is below broader industry forecasts in traditional sports betting circles, where it’s estimated that live betting accounts for anywhere between 70-80% of sports wagers.

Dota 2 and Valorant recorded the most in-play bets in the quarter, with 66% and 57% of live wagers, respectively.

Trendspotting

📈 Trending up: Creators role in gambling

The role of gaming creators in gambling marketing has been steadily growing over the last several years, driven by their ability to not only reach the next generation of consumers where they are, but also present brands and content in a more culturally relevant context.

Following a red-hot year of landmark influencer deals, the trend has continued into 2024 with Rivalry hosting a creator-led esports tournament in Toronto* and live streamer Ohnepixel becoming a co-owner of Skinbid.

Even outside of the video game sector, social media influencers are finding increased acceptance from betting industry stakeholders as they drive high volumes of consumer attention and engagement.

📉 Trending down: US esports betting regulation

Esports betting regulation in the US has been trending upward over the last several years, now available in more than a dozen states.

But based on the launch of new regulated sports betting states thought to be nearing a standstill (relative to the fast-and-swift spike in the last five years), the threshold for new esports betting regulation may start tapering off in the short- to medium-term unless officials advocate for amendments to existing legislation.

Still, the segment did experience a late tailwind in March with North Carolina launching online gambling with esports included and Bet365 taking SIS’s eBasketball product live in Kentucky.

Contact us

News tips, feedback, and sponsorship inquiries.

Reach me directly at luongomanagement@gmail.com 📩 or on Twitter 🐦

*Disclaimer: I am a full-time employee of Rivalry

It's always important to get the full picture as it pertains to trends and the ebb and flow of the gaming industry. Great job of alerting everyone to the future so they can adapt and revise their plans to capture that market in their business strategies.